A True Story and a Lesson for All Boat and Aircraft Owners

It was the year 1973, October 6th.

The world seemed to be holding its breath in fragile calm, especially in the Middle East. It was the week of Yom Kippur, the holiest day for the Jewish people, and it also coincided with the Muslim holy month of Ramadan.

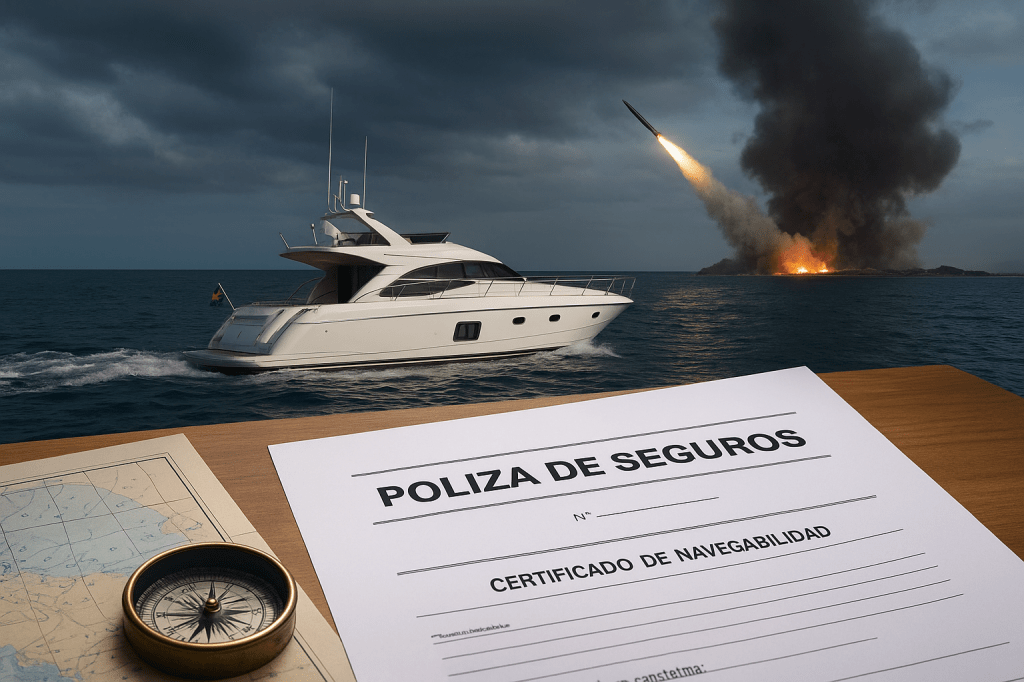

On the deck of his yacht, Captain Otto Hamer enjoyed the sea breeze. He was about to embark on a private trip to Israel. He carefully reviewed every document: permits, seaworthiness certificates, insurance policy… everything was in order.

At dawn, with good weather and calm seas, he set sail. Six hours later, in open waters, he received news that would change the course of his journey:

“Egypt and Syria have just launched a coordinated attack against Israel. All vessels must leave the area and return to a safe port.”

The captain confirmed he had been notified, but decided to continue to his destination. He arrived in Israel without incident, disembarked his passengers, and returned to his home port.

Three days later, his client called him to pick him up again in Israel. Otto agreed and sailed back into an area already declared a war exclusion zone. This time, luck was not on his side: a missile launched from an aircraft struck his vessel, sinking it completely. He managed to save his life and return to base as best as he could.

He filed a claim with the insurer, convinced he was covered by the war acts clause, declared or not. However, the company denied the payment.

Why did he lose coverage?

As a Senior Insurance Technician and specialist in aviation and vessel claims analysis, I reviewed the case and the conclusion was clear:

The war clause protects the insured interest against damage caused by war or acts of war, declared or undeclared. However, it is automatically voided once a conflict begins. The policy grants a specific period during which the insured, once notified, must return to a safe port:

- In aviation, a matter of hours.

- In vessels, a matter of days.

If the incident occurs within that period while the insured is heading to a safe port, the insurer pays. But if the insured voluntarily re-enters the war zone, coverage ceases to apply.

Captain Hamer was covered on his first return trip. But his second trip was a personal decision made amid an active conflict, so the insurer acted correctly and legally in denying compensation for the loss.

💡 Moral: An insurance policy is not a blank check to ignore risk. Knowing and respecting the coverage conditions can save not only your assets but also your life.

Get advice from a good professional like Senior Insurance Technician Juan Vicente Colón.

Deja un comentario